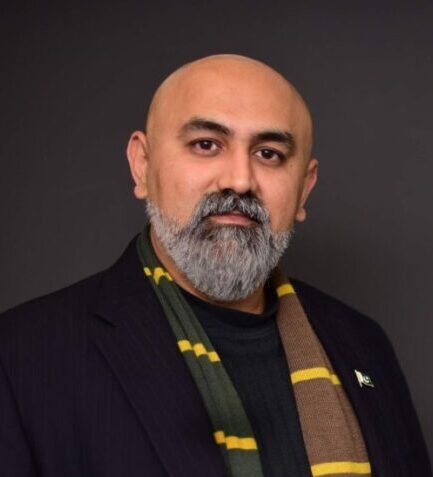

ISLAMABAD (WNAM REPORT): Chief Executive Officer of Pakistan Mercantile Exchange (PMEX), Khurram Zafar has prioritized for integrating the local market with the global competitive market through automation and digitization in the local supply value chain.

Khurram Zafar, CEO of PMEX, told in an interview that modernization is necessary to connect our markets with global markets and improve our export potential. It will compel the use of best practices like commodity grading and standardization, which international buyers rely upon.

Zafar said that PMEX wants to introduce innovation in the agriculture and commodity markets to make them more efficient, improve price discovery and reduce wastage.

“We are envisioning a future where currently fragmented commodity markets seamlessly integrate into a national trading platform that brings down the cost of intermediation, enhances price discovery, and allows traders to easily obtain financing against their commodities,” CEO, PMEX said that Commodity futures are derivative contracts in which the trader agrees to buy or sell a specific quantity of a physical commodity at a specified price on a particular date in the future to hedge the adverse price risk in the future.

Derivatives are investment contracts that derive their value from the price of another asset, typically called the underlying asset, and currently PMEX is the only regulated Exchange in Pakistan that can issue and trade these derivatives, he said, adding that the Exchange registered a trading volume of around Rs 3,800 billion already in the current Fiscal Year.

He said that Pakistan Mercantile Exchange is now focused on linking these derivative futures contract with the local economy of Pakistan by facilitating the development of efficient markets for spot price discovery of the underlying commodities.

He said that there is a need to digitize the agriculture and commodity markets across the country, and PMEX is aggressively working to collaborate with partners that will constitute this future ecosystem including warehouse operators, quality graders, farmers, traders, buyers, banks, insurance companies and agriculture inputs suppliers.

The CEO, PMEX said that currently there is an acute dearth of storage infrastructure in the country which results in a large percentage of our agricultural output to go to waste. The new market ecosystem will encourage small and large investors to build accredited storage facilities where farmers can safely store their harvest and obtain financing from banks against it. This will have a huge positive impact on our agricultural economy.

Zafar said that the government needs to collaborate with PMEX to modernize the market economy in Pakistan so that the country’s economy can move forward. Just like Special Economic Zones for industry, the government needs to notify Special Agriculture Markets Zones to encourage investment in the new markets ecosystem and create incentives for farmers, traders, commission agents and buyers to trade on this platform.

He said that the role of existing stakeholders, especially the commission agents or Aarhtis is very important to bring liquidity to the new markets and the design has to ensure that they are an integral part of the new ecosystem.

Pakistan Mercantile Exchange Limited (PMEX) is the country’s first and only demutualized commodity futures exchange, licensed and regulated by the Securities and Exchange Commission of Pakistan (SECP), he said.

CEO PMEX said that based on sophisticated risk management infrastructure and state-of-the-art technology, PMEX offers a complete suite of services i.e. trading, clearing and settlement, custody as well as back office, all under one roof.

He said that PMEX, formerly National Commodity Exchange, initially started trading in Gold only. Additional products were progressively introduced across all four asset classes: Metals, Financials, Energy, and Agriculture.

One of the latest products introduced by PMEX is 24K fractional gold contracts where anyone can invest in gold from as low as 300 Rupees.

PMEX ensures the gold’s purity, safe storage and insurance while providing investors an option to sell the gold any time or request physical delivery if the held amount exceed minimum delivery size requirements.

Finally, he said that the commodity market has its due potential to play a significant role in sustainable economic development of the country, for which coordination and integration of the local market is pivotal and PMEX is fully geared up to play the role of an anchor in this regard.

PMEX’s international affiliations include memberships of Association of Futures Markets (AFM), The World Federation of Exchanges (WFE), and Memorandum of Understanding (MoUs) with different Commodity Exchanges of the world, he said.