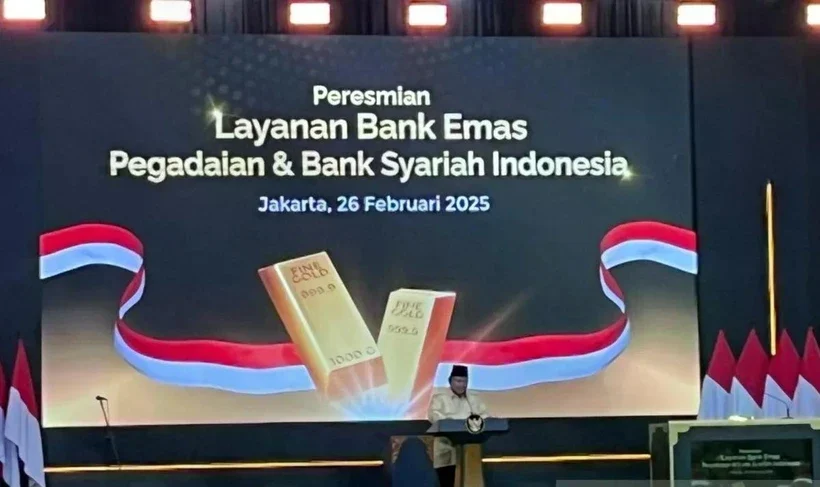

WNAM REPORT: Indonesian President Prabowo Subianto launched two “bullion banks” on February 26 that will provide gold deposit services to help keep stocks of gold onshore as the country looks to develop its commodity sector beyond mining.

Indonesia is one of the world’s top gold producers, but Prabowo has said that a lot of gold mined in Indonesia ends up being held overseas.

At the launch, the President said bullion banks can help the state save foreign exchange by allowing the entire gold supply chain to stay onshore.

He said that Indonesia’s gold production has risen from 100 tonnes to 160 tonnes now.

Jakarta has approved licenses to operate as a bullion bank for Pegadaian, a pawnshop subsidiary of state lender Bank Rakyat Indonesia BBRI.JK, and Bank Syariah Indonesia (BSI), the country’s largest Islamic bank BRIS.JK.

Both can now offer gold deposit, financing, trading and custody services to customers.

Financial firms are required to have at least 14 trillion IDR (850 million USD) in capital if they want to become a bullion bank, according to regulations on bullion businesses.